THE ECONOMICS OF THE WORLD

Posted on 20th October, 2016

The oil has been stored in tanks at four oil fields in Buliisa and Nwoya districts for about seven years.

The Government of Uganda has invited companies to buy 45,211 barrels of crude oil worth about Shs13 billion currently stored in specialised containers at four sites in Buliisa and Nwoya districts in Bunyoro and Acholi sub-regions respectively.

The Uganda National Oil Company (UNOC), the statutory agency charged with managing the government’s commercial interests in the oil industry, invited bids from companies in a notice published in the media yesterday.

The bid notice indicated that the qualified buyers/companies will be shortlisted directly for negotiations upon presenting satisfactory crude utilisation plans, and demonstrating quality, health, safety and environment (QHSE) management measures.

The crude oil for sale is currently stored in tanks at four oil fields of Kasemene 1, Ngara-1 and Ngiri-2 in Buliisa and Nwoya districts respectively. The test or trial crude oil has been lying in storage for about seven years. It was generated during the extended well testing (EWT) by oil companies Anglo-Irish Tullow Oil and French Total E&P.

The EWT is the process of evaluating both the characteristics of petroleum (oil and gas) reservoirs and establishing properties of crude oil to adequately plan for its production.

UNOC chief legal and corporate affairs officer Peter Muliisa declined to put a value to how much the government will earn from sale of the crude oil.

“There are several differentials you have to factor in before arriving at how much we could actually earn,” Mr Muliisa said.

However, at the prevailing trading price of $74 (Shs280,000) per barrel of Brent crude oil, the global benchmark, the 45,211 barrels could fetch about $3.3m (about Shs13b).

Nature of Uganda’s oil

Uganda’s (Brent) crude oil has low sulphur content, making it heavy, waxy and solidifies at room temperature or “sweet and heavy.”

One of the variables, besides transport costs, is to compare properties of Uganda’s crude oil to that from other countries such as in the Middle East and Nigeria to determine its fair worth.

“After taking into consideration everything and other factors kept constant, you could lose or gain some cents [on the international market], which is why we cannot put a figure right now,” Mr Muliisa said.

In January, UNOC announced a similar bid process to sell the test crude oil, with a closing date of March 9 for receiving bids, but the move did not materialise.

“We got a few expressions of interest but when we reviewed them, only one was reasonable. So we decided to go back to the market to attract new buyers,” Mr Muliisa explained.

He added that while money is a key consideration, “we are also paying due attention to the health, safety and environment aspects of managing the oil, including the caution required in transporting it from one location to another.”

In January, the Auditor General John Muwanga submitted a report to Parliament, blaming UNOC for failing to dispose of the test crude oil.

There have been attempts since 2012 to dispose of the oil but they were hampered by technical constraints such as the absence of an enabling legal regime. The required law has since been put in place following the enactment of the Petroleum (Exploration, Development and Production) Act 2013, which established UNOC that was incorporated in 2015 as a private company but wholly owned by government. The Energy and Finance ministries own 51 per cent and 49 per cent shares respectively. The company’s operations commenced in 2016.

Potential local buyers of the test crude oil include, but are not limited to, cement factories and thermal power generation plants, which import heavy fuel oil to generate electricity.

However, Mr Muliisa said in the absence of “a reasonable buyer”, they will continue storing the oil until the refinery is completed.

The government plans to construct a 60,000-barrel per day refinery in Hoima District to produce liquefied petroleum gas, diesel, petrol, kerosene, jet fuel and heavy fuel oil, among others, for both the local and regional market. At least 5 per cent of the 60,000 barrels will be used for heating the refinery.

According to the ministry of Energy, Uganda’s fuel/petroleum products imports as of last September averaged at 85 million litres, with demand growing at 7 per cent per annum. The 85 million litres comprised 34.6 million of petrol, 42.5 million of diesel, and 2.6 million of kerosene. Jet fuel imports stood at 5 million litres. In April, government signed a project framework agreement with the Albertine Graben Refinery Consortium (AGRC), a joint venture of American and Italian firms, to design, finance, construct and maintain the refinery, which is expected to cost $3b (Shs11 trillion).

The general manager of the Uganda Refinery Holding Company, Dr Michael Mugerwa, last week described the refinery as a “worthwhile investment” given its “extremely attractive internal rate of return.”

It is not clear when Uganda will start commercial oil production after it became apparent that the earlier target of 2020 cannot be met given the required high capital investment.

The government requires about $1b (about Shs3.8 trillion) to finance its equity stake in the upstream and midstream projects to enable it start commercial oil production.

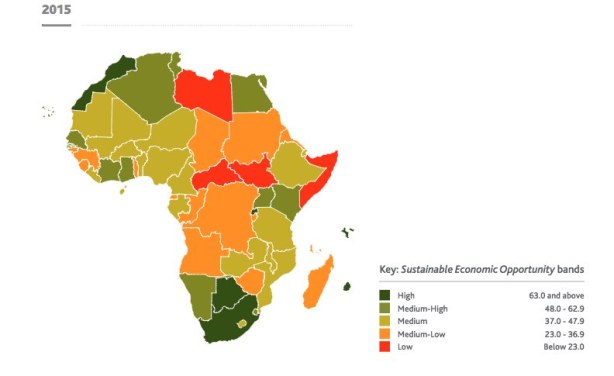

Global debt has increased too much in the world, the International Monetary Fund is warning Planet Earth:

By AFP

Added 5th October 2016

The easy money policies of the world's top central banks has fed the problem, stoking a private-sector credit binge in China and rising public debt in some low-income countries, the IMF said in a new report.

Bank governor Mark Carney (left) is widely expected to again delay a move on rates Wednesday, when policy-makers also issue their latest economic outlook in the closely watched quarterly Monetary Policy Report./AFP

Worldwide public and private debt is at an all-time high, posing a substantial impediment to getting global economic growth back to normal, the International Monetary Fund said Wednesday.

The easy money policies of the world's top central banks has fed the problem, stoking a private-sector credit binge in China and rising public debt in some low-income countries, the IMF said in a new report.

Meanwhile, slow economic growth is making it hard for both companies and countries to cut their debt burdens -- a process that can also drag on growth momentum because deleveraging companies slow spending and investment.

Without deleveraging, however, countries run the risk of fresh financial crises that can turn into deep recessions, the IMF's Fiscal Monitor report says.

"For a significant deleveraging to take place, restoring robust growth and returning to normal levels of inflation is necessary," the fund said.

Getting there requires governments to stimulate growth though investment, certain fiscal and business reforms, and targeted programs to help heavily indebted companies lower their debts.

"Global debt is at record highs and rising," the IMF's Fiscal Affairs Department chief Vitor Gaspar said.

Public and private debt -- excluding the financial sector's -- at the end of last year hit $152 trillion, with around two-thirds owed by the private sector, the report said.

Measured against the size of the world economy, it rose from less than 200 percent of global GDP to 225 percent over the 15 years to 2015.

Debt at such levels while economic growth remains tepid heightens the risk of financial crises, Gaspar said.

"High debt levels are costly as they often end up in financial recessions that are deeper and longer than normal recessions," he said in comments accompanying the report.

Moreover, "excessive private debt is a major headwind against the global recovery and a risk to financial stability."

While central banks have had to cut interest rates to support the recovery from the 2008 financial crisis, that has encouraged the debt pileup, the report said.

Dealing with the problem requires governments to implement well-calibrated programs to reduce private debt -- by cleaning up poor balance sheets of European banks and non-financial companies in China.

"Generally, where the financial system is under severe stress," the report said, "resolving the underlying problem quickly is critical."

Mr Severino Lukoya walks out of Gulu Central Police Station last year after briefly being detained following the death of a child at his temple.

Mr Severino Lukoya walks out of Gulu Central Police Station last year after briefly being detained following the death of a child at his temple.

Make A Comment

Comments (0)