Joseph Kasasira omu ku bassentebe abeetabye mu musomo ogwategekeddwa KCCA ku musolo gw’amayumba ng’annyonnyola bye bayitamu.

PULEZIDENTI Museveni ayimirizza omusolo gw’amayumba ogumaze ebbanga nga gwogeza abantu naddala bannannyini mayumba ebisongovu. Ekiragiro ekiwera omusolo guno yakiyisizza mu bbaluwa gye yawandiikidde minisita wa gavumenti ez’ebitundu, Tom Butime ng’amulagira okuguyimiriza.

Ebbaluwa yagiwandiise nga November 28, 2019. Mu bbaluwa, Pulezidenti yategeezezza nti azze afuna amawulire nti disitulikiti zibadde zisolooza omusolo gw’ebizimbe bino mu bubuga obutali bumu gwa bitundu 8 ku buli 100 n’agamba nti kino kirina okukoma mbagirawo kuba abantu abalina ebizimbe ebipangisibwa bakyali batono ddala era basaana okuweebwa omukisa okulekebwa bakulaakulanye bizinensi zaabwe awatali kutaataganyizibwa.

Yagambye nti balina okulinda waakiri ekitundu ekyo ne kikulaakulana okutuuka ku mutindo gwa Town Council oba Munisipaali olwo eby’omusolo guno biryoke birowoozebweko.

Yalabudde ne minisitule ya gavumenti ezeebitundu okukendeeza ku kupapirira okutondawo Town councils ne Munisipalite ennyingi nti zijja kuba nzibu okuziyimirizaawo.

Yawabudde nti ensimbi entono eziriwo kazikozesebwe ku bintu ebikwata ku bantu obutereevu omuli enguudo, amasannyalaze, amasomero n’amalwaliro. Yalabudde ababadde basolooza omusolo guno okukikomya mbagirawo okwewala okukaluubiriza Bannayuganda abali mu lutalo lw’okweggya mu bwavu ate okubazza mu misolo egitaliimu.

Ebbaluwa yagiweerezzaako omumyuka wa Pulezidenti, Sipiika wa Palamenti, Ssaabaminisita, baminisita, ababaka ba palamenti ne bassentebe ba disitulikiti. Ekiragiro kya Pulezidenti okuyimiriza omusolo we kijjidde ng’abantu bangi beemulugunya ku musolo guno olw’obutagutegeera n’okubanyigiriza.

Abaasembyeyo baabadde batuuze ba mu muluka gw’e Kansanga mu Munisipaali y’e Makindye wano mu Kampala.

Baavudde mu mbeera ne batabukira bakkansala baabwe ababakiikirira mu KCCA okwabadde Stephen Mugagga owa Kansanga B ne Diriisa Tebandeke owa Kansanga A nga balumiriza okwetumiikiriza okuyisa ennongoosereza mu tteeka erikwata ku musolo gw’amayumba nga tebabeebuuzizzaako.

Baabadde mu musomo ogwakoleddwa ekitongole kya KCCA okubasomesa ku musolo gw’aymaumba gwe baludde nga beemulugunyaako nti gubanyigiriza.

Abatuuze bagamba nti KCCA yabagerekera omusolo menene ogw’ebitundu 6 ku buli 100 nga bagamba abakulembeze baabwe be baasindika mu KCCA baali bateekwa okusooka okuddayo okubeebuuzaako.

Nb

Wano wetuweera abaziimbi bebizimbe amagezi bo baveyo bakole cooperatives ezizimbira abatuuze enyumba bo abatuuze basasule kibanja mpola. Ate nga governmenti bwemaze okukiriza nti yo tesobola kuddukanya byansula yabantu, egyewo nomusolo omunene gweteeka kubintu ebikozesebwa okuzimba amayumba okumala emyaka 10. Oluvanyuma nga ensi eno emaze okufuna ebizimbe ebyomulembe ebisamu saamu, eryoke okomyewo omusolo ogulemesa omuntu wabulijjo okuzimba enyumba eyomulembe eyokusulamu awamu nabantu be.

Kakati obanga omusolo gwebizimbe guvudewo nate kakati ensimbi zinavawa ezokuzimba enyumba ezomulembe. Ensi nyingi zizimba ebizimbe byomulembe okusuzaamu abakozi naddala mubibuga. Ate governmenti neziyamba abazimbi aba Private abalaga nga betaba mukuzimbira abatuuze enyumba oba ebizimbe ebirungi okubeera mu eri obulamu bwabwe. Wano estate ye Naguru kirabika kyeyava eremagana kubanga omutindo gwenyumba abakozi ba Uganda zebasulamu tegweyagaza nakamu. Era singa omusolo gwenyumba gutandise okusolozebwa, ensimbi ezo zibadde zijja kubuzibwawo. Abaguwa balemererwe nokugufunamu okwongera okulongoosa ebizimbe byabwe byebatawana nabyo okubirabirira. Ensula yomukozi we ggwanga embi, ekosa nyo ebyenfuna byensi.

Ugandans are unaware of mortgages, says a real estate developer:

Added 8th December 2019

“There are people paying a million or close to a million shillings in monthly rent yet they will never own those houses. They don’t know that some of the mortgage financing options in the banks provide for the same amounts and they would own those houses,”

Sam Bitangaro (secondleft) Member of Parliament and Emmanuel Sserunjoji (second right), Mayor of Kawempe division cut a tape during the launch of Kisasi Heights Apartments at Kisasi Kawempe division. (Photos by Ronnie Kijjambu)

Many Ugandans are ignorant about the available mortgage financing solutions in commercial lending institutions, an official of a real estate developer has said.

Fiona Mbabazi, the general manager of Mint Homes said they continue to pay rent for housing facilities they will never own under the arrangement.

“There are people paying a million or close to a million shillings in monthly rent yet they will never own those houses. They don’t know that some of the mortgage financing options in the banks provide for the same amounts and they would own those houses,” she said.

She made the revelation during a groundbreaking for construction of two and three-bedroomed housing units in Kanisa zone, Kikaya parish, Kawempe division in Kampala last week,

She said more Ugandans are buying homes for residential and investment purposes under mortgage financing arrangement

She said real estate developers face challenges of low-income earnings among the prospective home buyers and price instability in building materials that ‘disorganises’ their plans.

“When the prices of construction materials increase, it means we will not sell the house at the same price as advertised before since the building cost would have increased,” Mbabazi said.

The site of Mint Home where Kisasi Heights apartments are going to be constructed at Kisasi Kawempe division

If more people could earn ‘reasonable’ salaries, we could have more Ugandans owning homes.

She said one would be considered a reasonable salary earner if they took home at least sh2.5m monthly. She said few Ugandans earn this much.

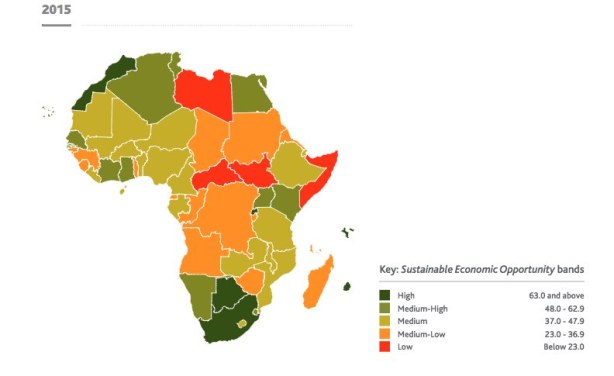

According to the Uganda Bureau of Statistics, Uganda has a deficit of 2.1 million housing units, growing at a rate of 200 000 units a year.

By 2030, the deficit is expected to reach three million units on account of the rapid urbanisation rate and a high population growth rate of 3.2 percent per annum.

According to the 2018 Revision of World Urbanization Prospects produced by the Population Division of the UN Department of Economic and Social Affairs, the world’s population living in urban areas is projected to rise to 68% by 2050 from 55% in 2018.

This will be on account of urbanization, gradual shift in residence of the human population from rural to urban areas and the overall growth of the world’s population.

This could add another 2.5 billion people to urban areas by 2050, with close to 90% of this increase taking place in Asia and Africa, according to a new United Nations data.

“The question we are asking ourselves is whether the urban centers are ready to receive that population,” Emmanuel Sserunjogi, the Kawempe division mayor said.

He hailed the company for making the investment and contributing to having a better city.

“We are fighting to make a good and liveable city for all, regardless of housing arrangement one has; whether if rental or owned,” he said.

Mbabazi said that they are considering locations out of the city that are still good enough for the company’s prospects; where land is not so expensive and can be suitable to build houses and lower-income earners.

“First of all, the price of land affects the price of houses. Finding places where land is not expensive means we shall have low-cost houses that can be affordable for the majority,” Mbabazi said.

“It has to be a location that has the same benefits that can be enjoyed like a person who is here (in Kampala). Such benefits include easy access to the road and availability of basic services like health and education.